BY JANET MANDELSTAM

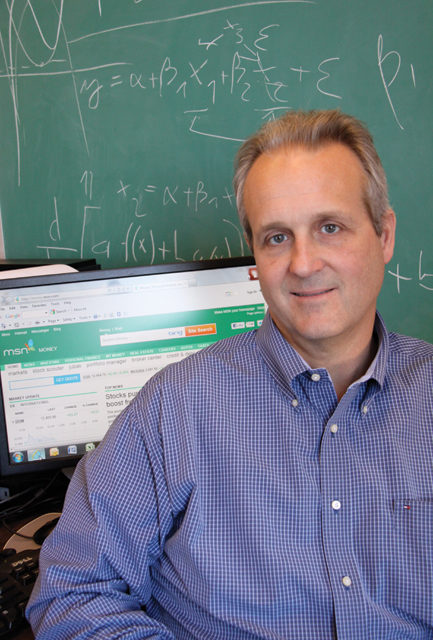

Actual retirement may occur at 65, 70, or any age, but planning for retirement can—and should—begin decades earlier, according to David Haeberle, who specializes in investment banking at the IU Kelley School of Business.

“An eighteen-year-old can start an Individual Retirement Account [IRA],” says Haeberle. “Invest as soon as you can, the earlier the better.”

Haeberle outlines a five-step plan for retirement that begins with paying off consumer debt such as credit card balances and auto loans, and, if you’re a homeowner, paying down the mortgage so that the balance is no more than twice your annual income. “That really is an investment,” he says, “because you are saving the interest yo

u would otherwise be paying.”

Then, if you are employed, participate in an employer-sponsored Qualified Retirement Plan like a 401(k) or 403(b), in which your employer matches your contributions up to a predetermined limit. “Put in as much as possible,” says Haeberle, “but only until the employer stops matching.”

That’s the time to open a Roth IRA, which Haeberle calls “one of the best retirement plans created, especially for lower-income and young people.” Unlike 401(k) plans, in which taxes are deferred until the money is withdrawn at retirement, “you have to pay tax on money you put in a Roth IRA now, but once the money is in the account and it grows, it can be taken out tax free.”

Haeberle also recommends Health Savings Accounts. With these accounts, an individual sets aside money that can be withdrawn tax free provided it is used for health care, before or after retirement. “It can be invested like any Qualified Retirement Plan, and if you remain healthy and don’t use the money, your kids can inherit it,” he says. (Of course, they will have to pay tax.)

And finally, “If you still have money to invest, go back into the employer-sponsored plan.”

As for where to invest those accounts, “you need a mix” of investments—stocks, bonds, certificates of deposit—but despite current fluctuations, the stock market still provides “the best return over time,” Haeberle says.

Patience really is a virtue when it comes to managing investments over time. “The long-term investor doesn’t care about volatility,” he says. “In negative economic times like today, you can buy low. You want to be a buyer when others are selling. Unless there’s a huge global meltdown, this is a fantastic time for investing.”